inheritance tax wisconsin rates

Married couples can avoid taxes as long as the estate is valued at. The top estate tax rate is 16 percent exemption threshold.

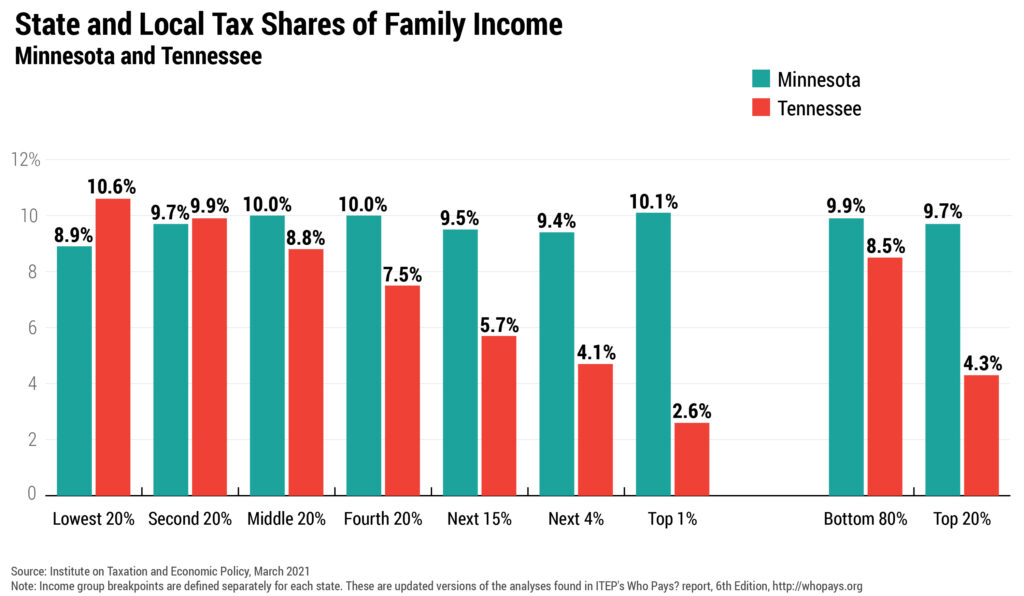

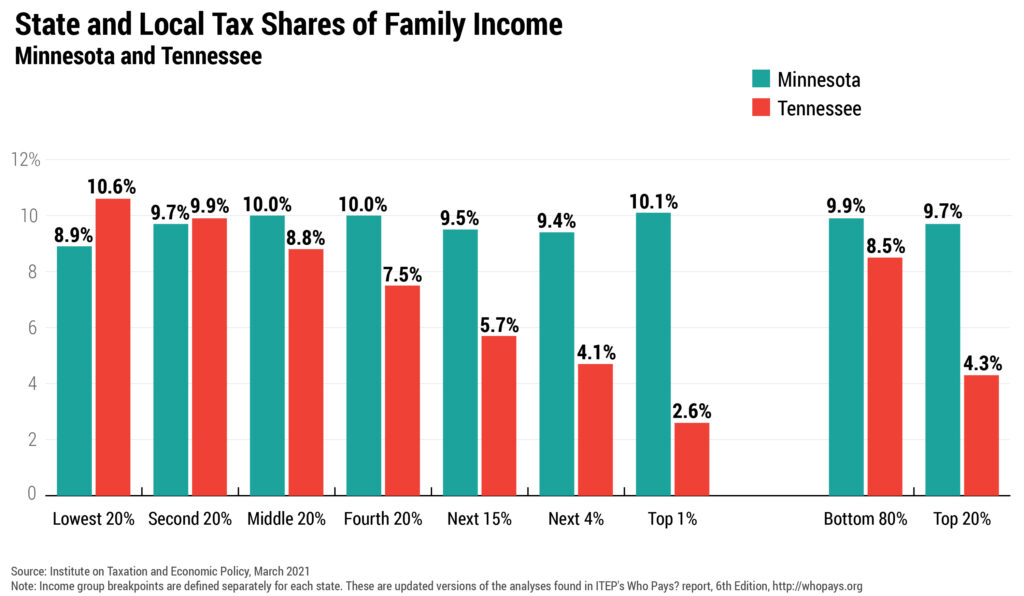

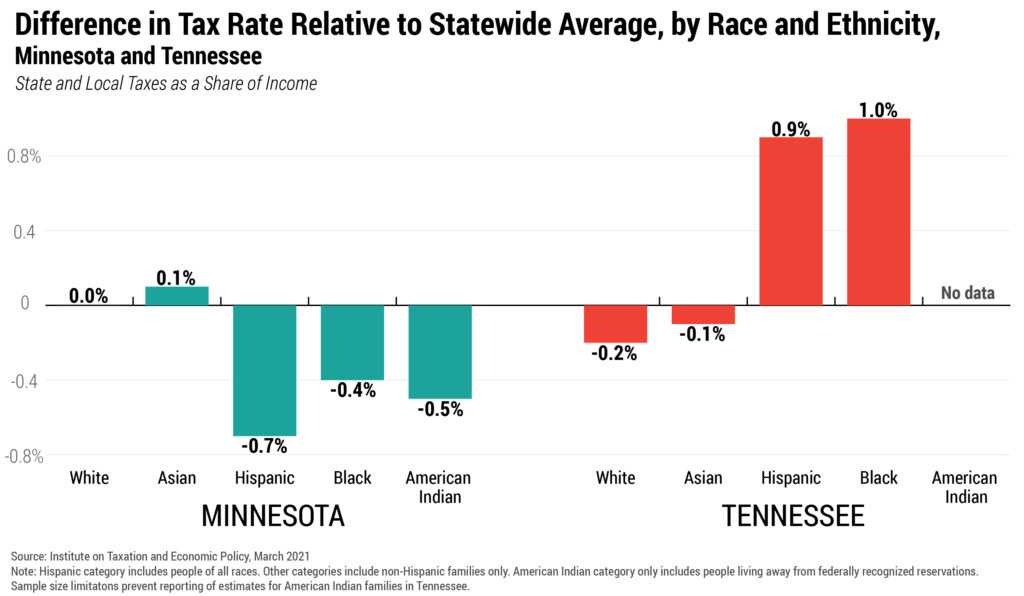

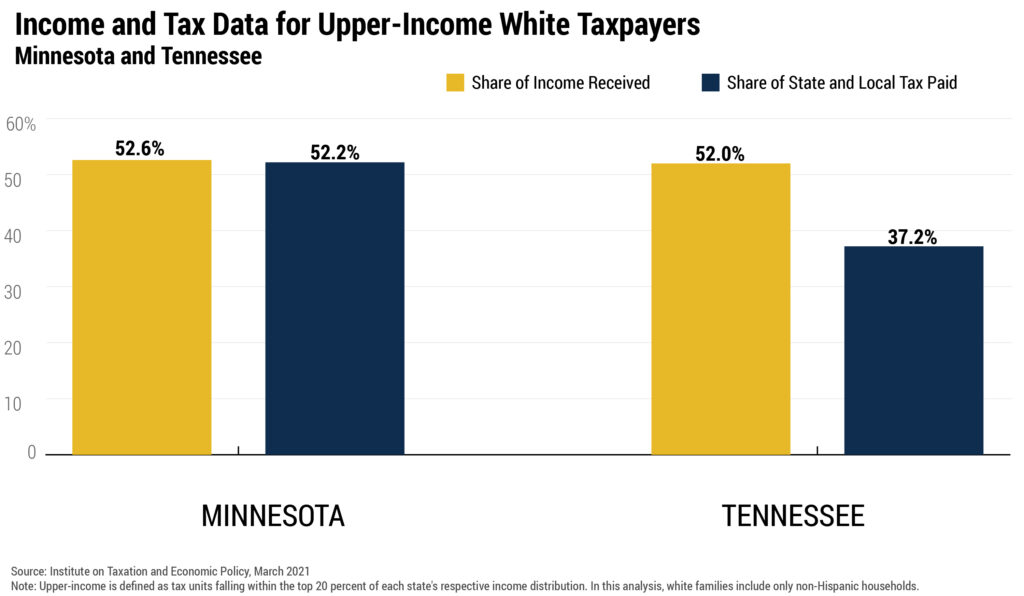

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

Wisconsin is a moderately tax friendly state.

. Wisconsin does not levy an inheritance tax or an estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent.

Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. This number doubles to 224 million for married couples. Washington DC District of Columbia.

Wisconsin Inheritance Tax Return. Wisconsin has among the highest property tax. In Wisconsin the capital gains tax rates are listed as follows.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Wisconsin also has a.

However if you are inheriting property from another state that state may have an estate tax that applies. People who receive less than 112 million as part of an estate can exclude all of it from their taxes. The higher exemption will expire Dec.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. 56 million West Virginia. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Key findings A federal estate tax ranging from 18 to 40 applies to all estates worth more than. The sales tax rates in Wisconsin rage form 500 to 550. In 2022 the federal estate tax generally applies to.

Keep reading for all the most recent estate and inheritance tax rates by state. As provided under EGTRAA all of the rates except those at the top remain the same as they were under prior law. Wisconsin does not have a state inheritance or estate tax.

INHERITANCE AND ESTATE TAX. But currently Wisconsin has no inheritance tax. No estate tax or inheritance tax.

GENERAL TOPICAL INDEX. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Inheritance tax wisconsin rates.

Wisconsin tax structure. State inheritance tax rates range from 1 up to 16. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1 million according to an.

There is no federal tax on. Inheritances that fall below these exemption amounts arent subject to the tax. 65 which does not account for the 30 exclusion.

Wisconsin does not levy an inheritance tax or an estate tax. No estate tax or. The graduated tax rates ranged from 18 to 55.

Income tax rates in Wisconsin range from 354 to 765. Washington has the highest estate tax at 20 applied to the portion of an estates value. Florida is a well.

The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. If death occurred prior to January 1 1992 contact the Department of. The property tax rates are among some of the highest in the country at around 2.

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

These Are The Best And Worst States For Taxes In 2019

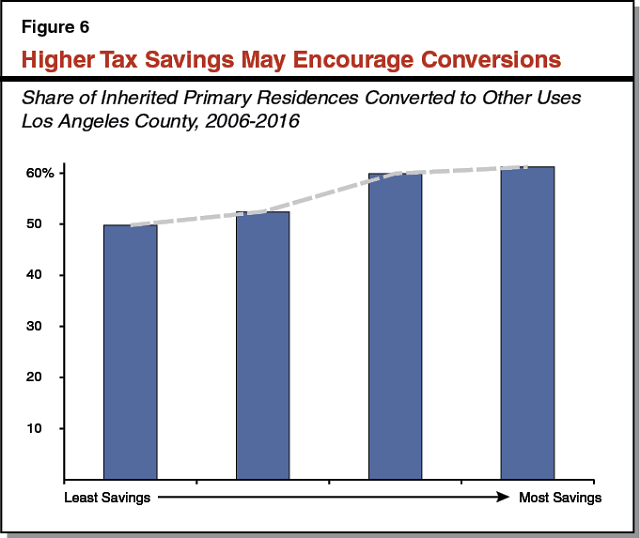

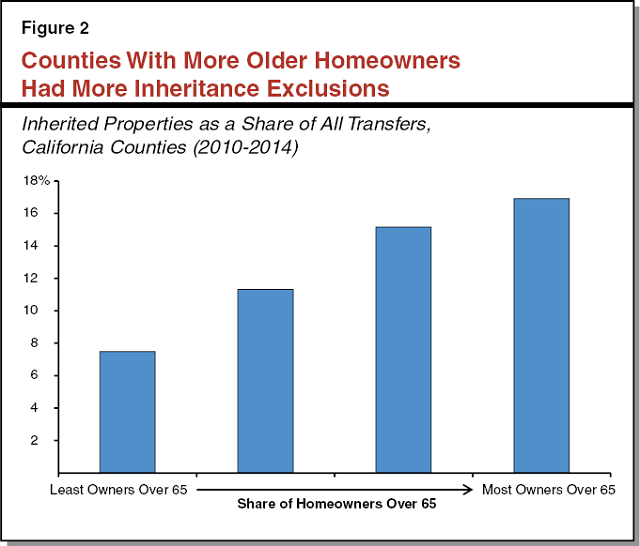

The Property Tax Inheritance Exclusion

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Estate Tax Planning Tesar Law Group S C

Property Tax Payments Outagamie County Wi

Using Gifting Between Spouses To Maximize Step Up In Basis

Estate Tax Planning Tesar Law Group S C

The Property Tax Inheritance Exclusion

The Property Tax Inheritance Exclusion

Estate Tax Planning Tesar Law Group S C

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Britons Face Worst Living Standards Plunge Since The 1950s Despite Sunak Moves Daily Mail Online

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep